Are you planning on upgrading your headphones or audio equipment? Think again. The global trade landscape is shifting, and tariffs are poised to significantly impact the prices of audio gear, both domestically produced and imported. This article explores how tariffs on imported components and finished goods are driving up costs for manufacturers, ultimately leading to higher prices for consumers worldwide. We'll examine the ripple effects of these tariffs, demonstrating how even seemingly small taxes can translate into substantial increases in the final cost of your favorite headphones or speakers.This analysis delves into the challenges faced by both US and international manufacturers. We'll unpack how tariffs on imported components affect production costs, forcing price hikes to maintain profitability. The impact extends beyond direct tariff costs, incorporating the effects of decreased sales and the subsequent need to reallocate fixed costs. We'll also discuss the potential removal of the de minimis exemption, further impacting consumers who previously enjoyed tariff-free importation of lower-priced goods. Prepare to learn how this perfect storm of economic factors is about to change the audio market.

Read more: EPZ P50 In-Ear Monitor Review: A Breakout Performer?

Understanding Tariffs and Their Impact

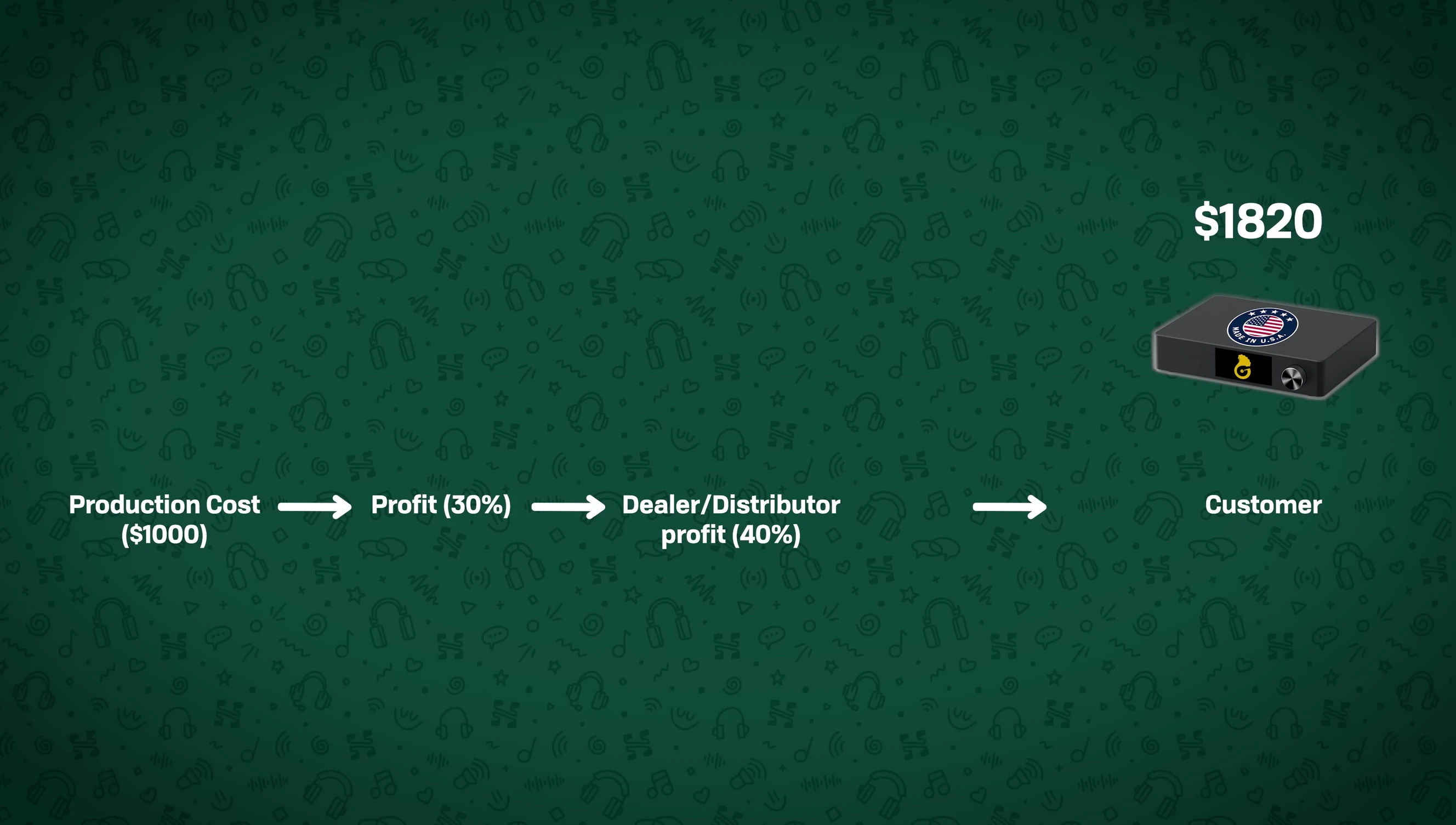

Tariffs are taxes imposed by one country on goods imported from another. These taxes significantly impact the final price consumers pay. For instance, a 20% tariff on headphones imported from China means a $200 increase on a $1000 pair, regardless of whether the buyer purchases directly from China or a US dealer who absorbed the initial cost.

This cost isn't solely borne by the importing country's businesses. It ultimately trickles down to consumers, leading to higher prices for both imported and domestically produced goods.

The belief that buying 'American-made' avoids tariffs is misleading. Many US manufacturers rely on imported components, meaning tariffs on those components increase their production costs and the final price.

The Ripple Effect on US Manufacturers

Even US manufacturers face challenges. If half their components are imported and subject to a 20% tariff, their production costs rise considerably. This necessitates price increases to maintain profitability.

Increased component costs aren't the only factor. Tariffs can also lead to decreased sales due to higher prices, forcing manufacturers to spread fixed costs (rent, salaries, R&D) across fewer units, further raising the price per unit.

This scenario highlights how a 20% tariff can lead to a price increase exceeding 20%, especially when factoring in reduced sales and the subsequent need to re-amortize fixed costs.

International Implications and De Minimis Exemptions

US manufacturers face increased competition from companies in countries unaffected by tariffs. This competitive disadvantage forces them to either absorb losses or increase prices across all markets.

The de minimis exemption, previously allowing importation of goods under $800 without tariffs, has been threatened with removal. This impacts consumers in the US who previously avoided paying tariffs on lower-priced items.

While countries outside the US may currently see minimal price changes, potential reciprocal tariffs could ripple globally, affecting prices beyond the US.

Conclusion: The Rising Cost of Audio

The current trade landscape indicates a likely increase in audio equipment prices. Tariffs directly increase the cost of imported goods, while indirectly impacting the cost of domestically-produced products due to increased component costs.

This affects both US and international consumers. While international consumers might see smaller price increases than those in the US, the impact is still present.

Planning a high-end audio purchase soon might be wise, considering the inevitable price increases on the horizon.